Software as a Service (SaaS) is an elegant business model. Once you build the product, you can sell it to any number of customers. The only changes required are minor tweaks to the configuration. SaaS businesses work by charging a recurring fee. At each billing cycle, we need to re-earn the trust of our customers, creating a powerful alignment of interest between us and the customers we serve.

For customers, SaaS just works™. They don’t have to install anything and paying a smaller recurring fee is a lot more palatable on the balance books. For us, SaaS has two benefits. First, having recurring revenue makes our finances predictable. Second, it cuts down development overhead, since new products can be rolled out simultaneously to all clients.

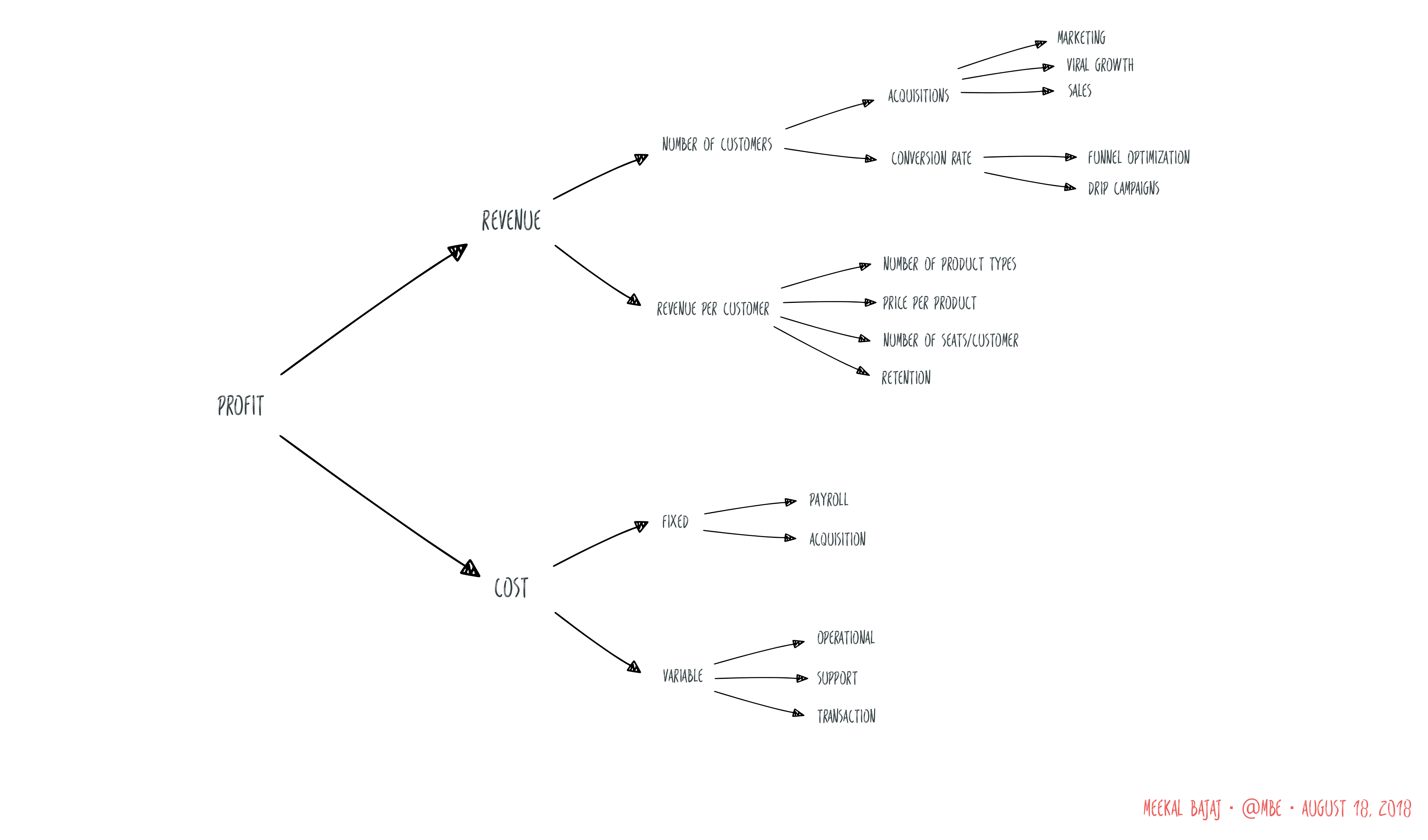

To understand the SaaS business, let’s deconstruct the levers that control it.

Financially, the objective of a business is to increase profitability, where

Profit = Revenue - Cost

There are two ways we can increase profitability. Either we increase revenue or decrease costs.

Revenue

For a SaaS business, revenue can be modeled as:

Revenue = Number of customers * Revenue/Customer

or more completely,

Revenue = Number of customers * Number of product types * Price per product type * Number of seats/customer * Retention rate

To increase revenue, we control the following levers.

Number of product types sold

There are two ways to increase the number of product types we sell to customers.

- Build more products. The more impactful but costly approach is to develop new product lines to sell. For example, at Benchling, we built out Workflows and Requests as new product lines that expanded the suite of products our customers purchased. Similarly, Atlassian let’s you buy Jira and Confluence as separate products.

- Segment existing product lines. Create tiers that appeal to different segments of the market by gating functionality. For example, at Benchling, Notebook Plus allows us to charge a premium on our Notebook product that appeals to teams collecting structured data. Selling a read-only license enables us to tap into seats that clients would typically shy away from purchasing.

Price per product type

The easiest way to grow revenue is to raise the price of each product line. As long as the market is willing to pay more, growing revenue by raising prices requires no development. In an ideal world, we have perfect price inelasticity, i.e. we can raise the price without losing any customers. That will only happen when our product offers unique value that no-one else can match.

To figure out just how much we can price the product at, we triangulate pricing for SaaS through a few strategies.

- Value based pricing. Understand what value we are adding, and capture some percentage of that value.

- Competitive pricing. Look at what others are charging for similar products.

- Experimental pricing. Experiment raising the price to measure it’s impact on demand.

Number of seats per customer

A non exhaustive set of strategies to increase the number of seats

- Empower evangelists. Give your champions tools to convince others. Offer training sessions, support, access to help articles, and special features.

- Default to permissiveness. Most companies worry about people using their software without paying for it. The far bigger challenge in enterprise software is getting people to use your product in the first place. Instead of gating access to features, enable them by default and monitor usage. If people start using features they didn’t pay for, after a few cycles bring up extending the contract or offering to take them away after. If people have already spent time training themselves and collecting data against it, it’s unlikely that they will back away from paying the upgrade fee.

- Support extensibility. People rarely work with just one tool. Build the bridges that let them collaborate with other products by either supporting integrations or easier ways to share out from the platform. For example Slack Apps integrate with an extensive suite of business apps that enhance it’s utility.

Retention

Retention is a measure of the number of completed payment cycles. Customers churn when someone else does a significantly better job of delivering value. Competitors need to create such a compelling proposition that it persuades our customers to overcome inertia, training, and migration costs. To lose a customer means that we weren’t listening.

To ensure customers stay, SaaS businesses need a Customer Success (CS) team. The tactics used by CS to drive retention are:

- Training users. Teaching not just the capabilities of the software but also the workarounds.

- Being responsive. Ensuring that people know how to get timely help if they get stuck.

- Sharing feedback with the product team. As the first group to hear the customer pain points, CS is in a unique position to share feedback with the product team on what people are trying to do, their pain points, and the severity of the issue.

Number of customers

The number of customers can be modelled as

Number of customers = Acquisitions * Conversion rate

The levers we have are either increase the number of leads coming in through the gate, or increase our success at converting them into paying customers.

While the strategies for growing the number of customers is too broad a topic to cover here, we have Marketing and Sales organizations that are uniquely focused on this.

Costs

Key sources of costs in a SaaS business can broadly be considered as;

- Development Payroll costs for engineers, designers, and other members of the product development team. For SaaS businesses, this tends to be one of the largest sources of expense. For example, a team of 10 engineers working on a product for a year can easily require $1.2 million.

- Support, time invested in training and supporting customers.

- Operational, costs such as servers and storage that need to be paid to AWS for running the business.

- Transactional, fees paid to vendors such as credit card processors for payments etc.

Financial model

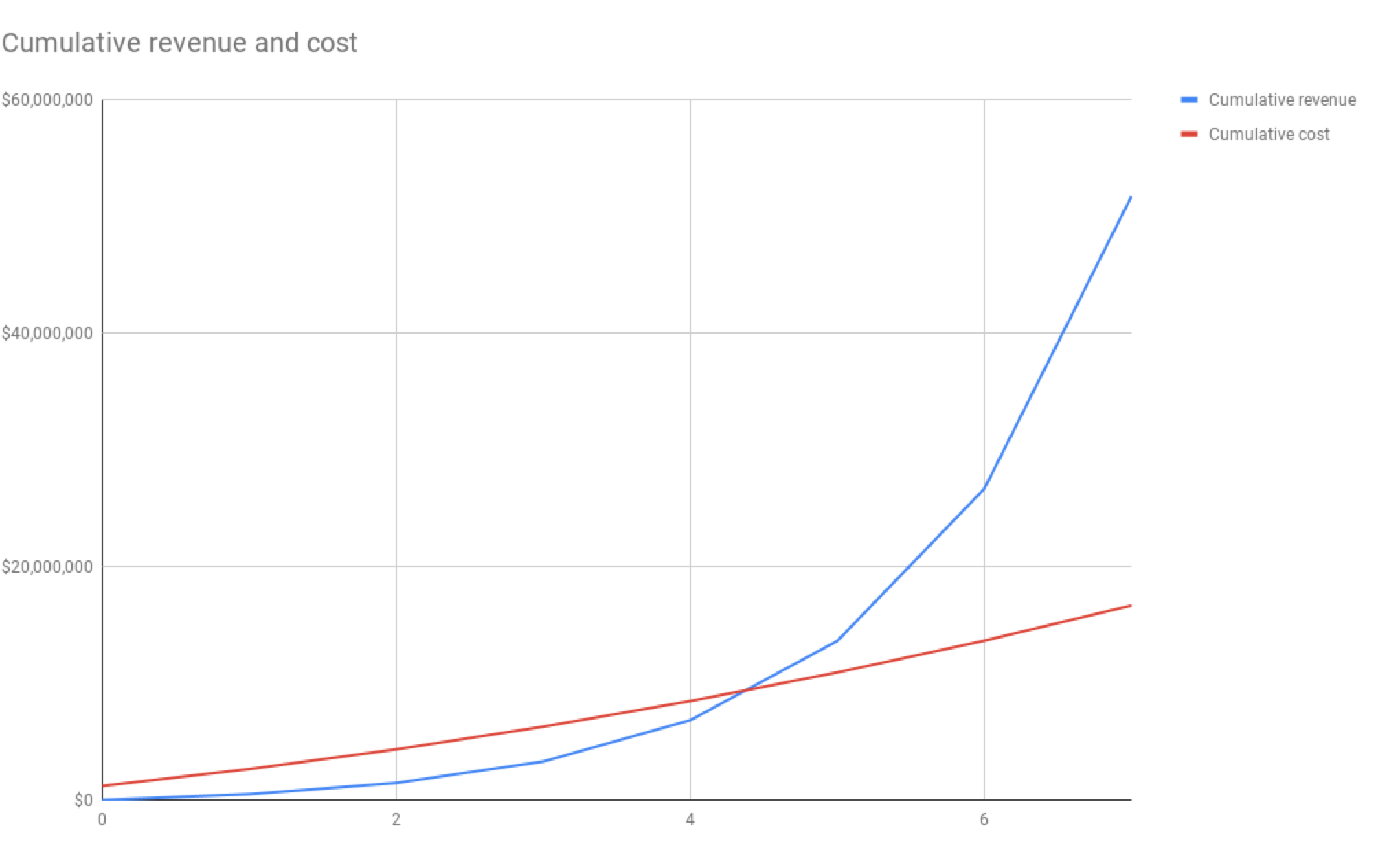

The core thesis of a SaaS business is that the costs grow roughly linearly whereas revenue grows exponentially. To see it in action, let’s create a very simple business model:

| Assumptions | |

|---|---|

| Number of product lines | 5 |

| Avg price per product line | $1,000 |

| Starting number of customers | 5 |

| Avg number of seats/customer | 20 |

| Upsell rate (Avg seats/contract per payment cycle) | 20% |

| Growth rate (# of customers growth rate per payment cycle) | 60% |

| Churn rate (Revenue lost per payment cycle) | 5% |

| Number of engineers | 10 |

| New engineers per year | 2 |

| Avg annual salary | $120,000 |

| Operational cost of new deploy | $1,000 |

Where revenue is:

Revenue = Number of product lines

* Avg price per product line

* Number of customers * (1 + customer growth) ^ n

* Avg # of seats/customer * (1 + upsell rate) ^ n

- Previous payment cycle revenue * Churn rate

and cost is

Cost = (Operational cost of deploy * Number of customers)

+ (Avg annual salary * (Number of engineers + New engineers/year * n))

- (Transaction fee * Gross Revenue)

While we start in the red, over a period of time we see incredibly attractive returns.

| Year -> | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 0 | $500,000 | $935,000 | $1,796,450 | $3,449,122 | $6,622,316 | $12,714,847 | $24,412,507 |

| Cost | $1,205,000 | $1,448,000 | $1,692,800 | $1,940,480 | $2,192,768 | $2,452,429 | $2,723,886 | $3,014,218 |

| Cumulative revenue | 0 | $500,000 | $1,460,000 | $3,303,200 | $6,842,144 | $13,636,916 | $26,682,880 | $51,731,129 |

| Cumulative cost | $1,205,000 | $2,653,000 | $4,345,800 | $6,286,280 | $8,479,048 | $10,931,477 | $13,655,363 | $16,669,581 |

Plotting the cumulative values against each other, over time we get:

Understanding the levers at play empower us to diagnose issues and drive outcomes. What levers have you found impactful in managing your SaaS business? Let’s continue this conversation on Twitter @mbe